All Categories

Featured

Table of Contents

- – Fascination About What Is No-exam Life Insuran...

- – The smart Trick of Life Insurance That Nobody ...

- – The Ultimate Guide To Best No-exam Life Insur...

- – 3 Best No-exam Life Insurance Policies In Mar...

- – The Main Principles Of Life Insurance

- – No Exam Life Insurance [Instant & Free Quote...

- – Indicators on How To Get Instant Life Insura...

: If you have health concerns that have created life insurance providers to decline your applications, guaranteed problem life insurance policy can be a method to obtain insurance coverage without bringing your wellness right into concern whatsoever. You'll still require to meet age restrictions, and your coverage may be dramatically more expensive and restricted.

Coverage will be set at a percentage of or 1-2 times your salary potentially not as restricted as assured concern life insurance policy coverage. Keep in mind that these policies may just remain active while you're still with the company and commonly only use minimal protection amounts that you may intend to supplement with another plan.

It's difficult for an insurance provider to fully evaluate your way of living and health and wellness without health-related details. The greater danger they take on by providing insurance policy without the insight of a wellness test is balanced out by a higher premium. If you have a medical problem that you handle well, you may still get approved for a common life insurance coverage plan with a much more budget friendly premium than the no-exam choices.

Fascination About What Is No-exam Life Insurance And How Does It Work?

A device of protection represents the life insurance coverage benefit amount you can buy. It relies on age, sex (in Montana, age only) and state. Please obtain a quote to see advantage amounts and costs available to you for approximately 25 devices of protection. You do not have to address any type of questions about your wellness or take a physical examination.

Your insurance coverage can remain in force as long as you pay your costs when due. Yes. If your coverage is in pressure and has a cash money value indeed, you might obtain a financing on it. The rate of interest price is 8% worsened yearly. Any type of financing amount and passion that has not been repaid at the time of death is deducted from the survivor benefit.

The smart Trick of Life Insurance That Nobody is Discussing

Life can be made complex, so when you locate a way to simplify the complicated particularly for something as vital as buying life insurance coverage it's only natural to be curious. Lots of firms today use life insurance coverage without any medical exam as a fast and non-invasive means to get the defense you require.

As the name suggests, no-exam life insurance policy can issue a plan to you without needing a medical examination, dramatically reducing what can often be a lengthy challenge, which can include lab work and a lengthy application. Historically, life insurance providers have needed a medical test to aid offer the insurance coverage company a better photo of your health and wellness.

It is planned for individuals who desire rapid insurance coverage, without a complex underwriting process. While it may be extra expensive than plans via accelerated underwriting, it can be an appropriate option for people who have health worries or require instantaneous insurance coverage. Benefits: For streamlined life insurance policy, there are usually less concerns to respond to, and fewer resources utilized to collect your data.

Advantages: With assured concern life insurance coverage, you're assured protection, as the name recommends. There is no test and there are no inquiries to respond to, with age usually being the only limitation. Limitations: These policies use really restricted protection (commonly regarding $25,000) and will cost a lot even more than standard life insurance.

Given that streamlined concern plans gather less details than completely underwritten plans, prices often tends to be higher and has insurance coverage amounts $1 million or reduced. An ensured concern plan might be the only option for individuals that with specific medical conditions or insurance coverage threats, so the greater cost may be worth the coverage relying on the demand.

Please keep in mind that this write-up is implied to enlighten and clarify some of the terms made use of by life insurance firms. Nationwide offers a sped up underwriting process on Nationwide Life Fundamentals and Nationwide Ensured Level Term. Nationwide uses a Simplified Whole Life product for existing Across the country car and property owner's insurance members.

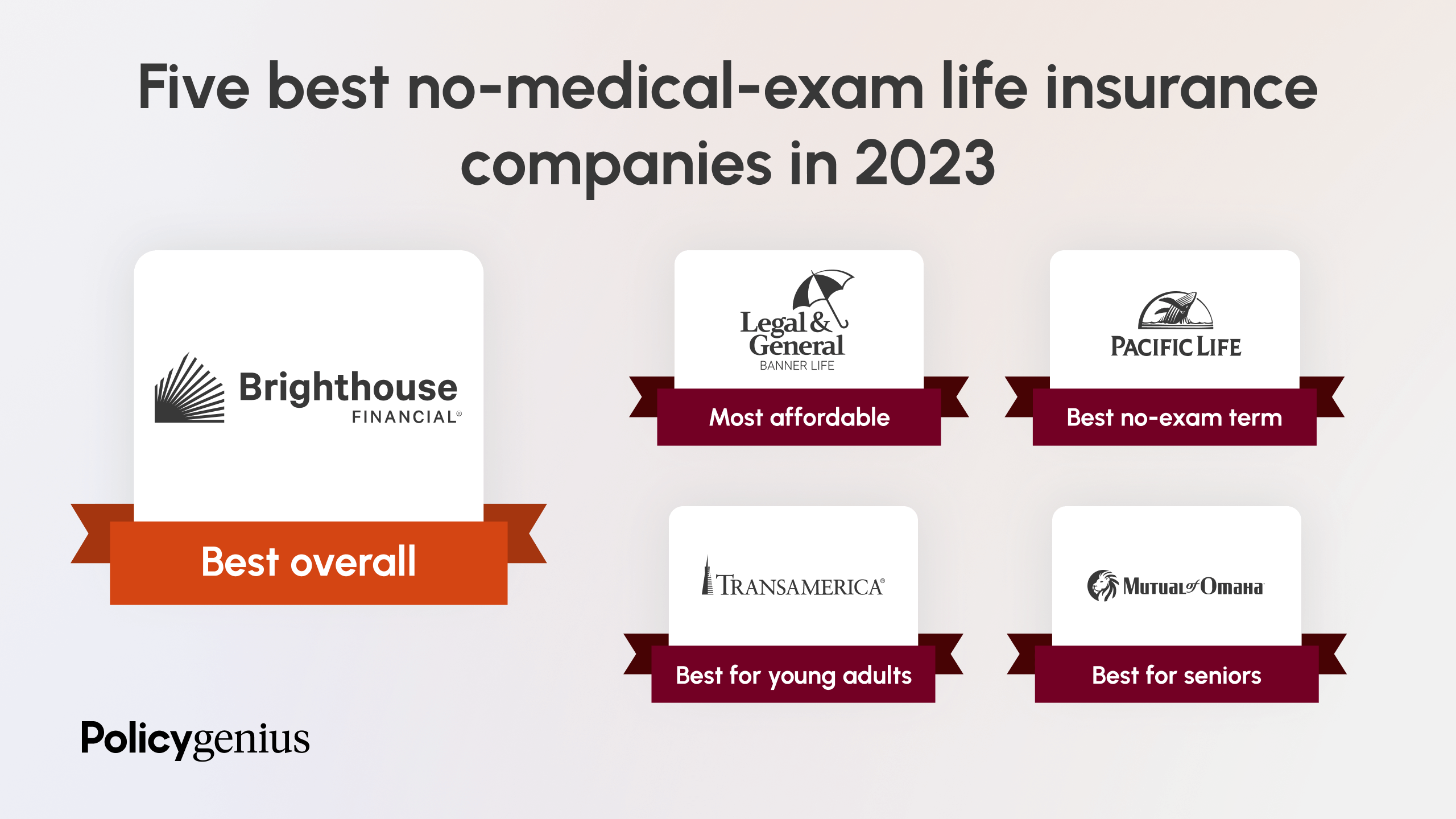

The Ultimate Guide To Best No-exam Life Insurance Companies (2025)

Generally $100,000 $250,000. This protection can be Whole Life or Term. Simplified issue policies do not call for a clinical exam, but the applicant will certainly need to address details health and wellness questions as part of the application process. Premiums for Simplified Concern plans will additionally be significantly more than standard policies. Along with higher costs, several Simplified Concern plans have a graded survivor benefit and only pay a claim if the insured dies 2 years after the problem date of the plan.

In the event where Accelerated Underwriting can not be completed, traditional underwriting with a medical examination would be required. Instant Problem policies share the very same prices as Traditional policies. Qualification for no medical examination life insurance policy varies from company to company and is based on the type of no medical examination life insurance policy policy desired.

Premium rates/costs of no clinical examination life insurance policy policies vary by sort of policy, insurance provider and the insured's age. The much less information an insurance provider knows regarding you, the a lot more you will pay since the insurer is presuming more threat. Surefire Concern plans will certainly be the most expenditure, for the insurance coverage amount bought, followed by Simplified Problem.

And, you will have accessibility to the outcomes of your clinical examination, so consider it as a complimentary physical. At McFie Insurance policy, we concentrate on making the best life insurance policy policies for you. After assessing your economic circumstance, we'll aid you find the plan and protection amount that will be best for you, to ensure that you can have comfort.

There are several means to access information about finances, however it can be hard to establish which sources are trustworthy. I such as to put details with each other in a precise, simple, understandable fashion so individuals can make great economic decisions based on the information given without needing to lose time questioning if the source is trustworthy.

3 Best No-exam Life Insurance Policies In March 2025 - Questions

Get the protection your family needs, without wellness questions and no clinical exam. With Ensured Problem Life, you can remain guaranteed for life. Your insurance coverage will certainly never ever lower, and your costs will certainly never ever boost. You can conserve substantially on your costs if you don't smoke. This is not a contract.

Benefits will not be paid if death results from suicide or, directly or indirectly, from a pre-existing condition within two years of the efficient day of the plan. In the instance of self-destruction, we will return all costs paid without any kind of interest modification.

The Main Principles Of Life Insurance

We do not make money for our reviews. The conventional term life insurance coverage rates in the graph above are from Corebridge Financial, Place Life, Legal & General America, Lincoln, Mutual of Omaha, Pacific Life, and Safety. The no-exam term life insurance coverage rates are from Everly, Foresters, and Lincoln. Our reviews and suggestions can assist you discover a trustworthy insurance company for your family's financial security, however the ideal life insurance policy firm for you relies on multiple factors.

Generally $100,000 $250,000. This insurance coverage can be Whole Life or Term. Simplified problem plans do not call for a clinical examination, yet the applicant will certainly need to respond to specific wellness questions as component of the application process. Premiums for Simplified Issue policies will certainly also be significantly more than conventional plans. In enhancement to higher premiums, many Simplified Issue plans have actually a graded survivor benefit and only pay an insurance claim if the insured dies 2 years after the issue day of the policy.

In case where Accelerated Underwriting can not be completed, typical underwriting with a medical examination would certainly be needed. Instant Problem plans share the very same prices as Conventional plans. Eligibility for no medical exam life insurance varies from business to firm and is based upon the type of no clinical exam life insurance policy policy desired.

Costs rates/costs of no medical examination life insurance policy plans differ by kind of plan, insurer and the insured's age. The less details an insurance provider understands about you, the a lot more you will pay due to the fact that the insurance provider is presuming more threat. Surefire Issue plans will be one of the most expenditure, for the insurance coverage amount acquired, adhered to by Simplified Concern.

No Exam Life Insurance [Instant & Free Quotes] Things To Know Before You Buy

And, you will have accessibility to the outcomes of your medical examination, so think about it as a totally free physical. At McFie Insurance, we focus on designing the ideal life insurance coverage plans for you. After assessing your monetary circumstance, we'll assist you find the plan and protection amount that will be best for you, so that you can have peace of mind.

There are many ways to access information regarding financial resources, but it can be tough to identify which resources are credible. I like to place info together in a precise, simple, understandable way so people can make great economic decisions based on the details given without having to waste time wondering if the source is trustworthy.

Obtain the defense your family needs, with no wellness concerns and no clinical examination. With Assured Issue Life, you can remain guaranteed for life.

Indicators on How To Get Instant Life Insurance Online You Need To Know

It has vital information worrying exclusions, conditions and constraints. Please review it meticulously when you obtain it. Advantages will not be paid if fatality arises from suicide or, straight or indirectly, from a pre-existing condition within 2 years of the effective day of the plan. When it comes to self-destruction, we will certainly return all premiums paid with no rate of interest adjustment.

We don't make money for our reviews. The typical term life insurance policy rates in the chart above are from Corebridge Financial, Haven Life, Legal & General America, Lincoln, Mutual of Omaha, Pacific Life, and Protective. The no-exam term life insurance policy prices are from Everly, Foresters, and Lincoln. Our reviews and recommendations can assist you discover a trustworthy insurance company for your family's monetary protection, however the very best life insurance policy business for you depends upon multiple elements.

Table of Contents

- – Fascination About What Is No-exam Life Insuran...

- – The smart Trick of Life Insurance That Nobody ...

- – The Ultimate Guide To Best No-exam Life Insur...

- – 3 Best No-exam Life Insurance Policies In Mar...

- – The Main Principles Of Life Insurance

- – No Exam Life Insurance [Instant & Free Quote...

- – Indicators on How To Get Instant Life Insura...

Latest Posts

Fascination About Guaranteed Issue Life Insurance Policies

No Exam Life Insurance [Instant & Free Quotes] Things To Know Before You Buy

The 3-Minute Rule for Can I Get Life Insurance With No Medical Exam?

More

Latest Posts

Fascination About Guaranteed Issue Life Insurance Policies

No Exam Life Insurance [Instant & Free Quotes] Things To Know Before You Buy

The 3-Minute Rule for Can I Get Life Insurance With No Medical Exam?